Training

”The training was useful and very interesting. Good to include discussion within the group" Attendee feedback

With years of experience at the Commission, FIU and in Industry, our training packages draw upon our exclusive knowledge and practical experience to ensure businesses and their staff meet regulatory standards. We have a friendly approachable training style to encourage learning in a relaxed environment. We can deliver in person, virtually, or on a one to one basis, whilst also tailoring the training to your needs.

Tailored to your business

Case Study Led Training

ThreeSixty’s training is underpinned by case studies based on real world experiences. Not only do you learn the legal and regulatory requirements, but you will also understand the practical application.

Comments from attendees:

“I enjoyed the case studies because it is nice to be able to transfer knowledge”

“The actual case studies – helps to put it in context”

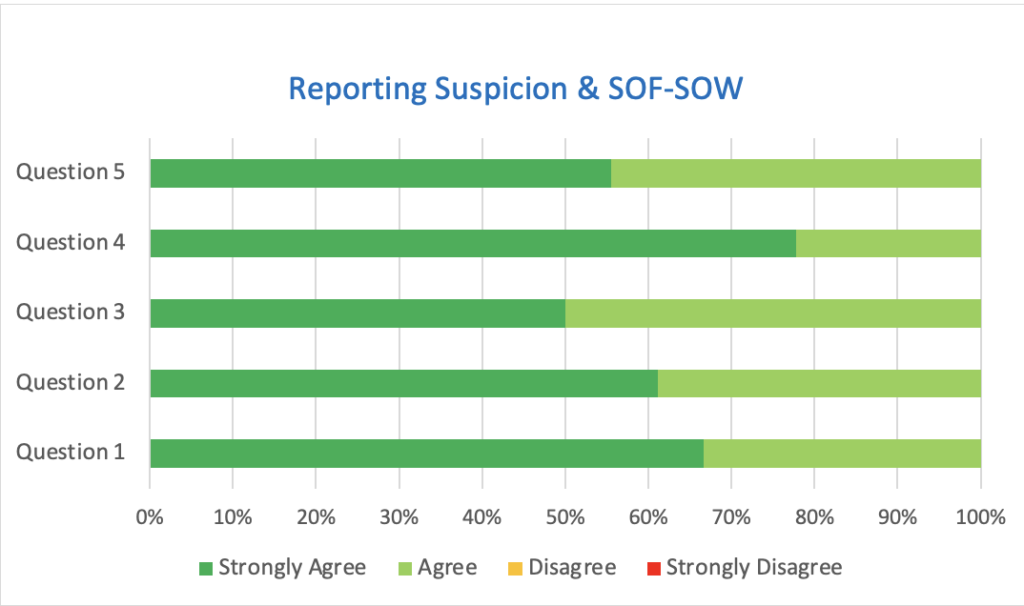

- The objectives of the training were met.

- The training material was relevant and easy to follow.

- The training was not too long.

- The trainer(s) were engaged and able to answer any questions.

- I would attend future ThreeSixty training sessions.

Training Modules

Board and Senior Management

It’s important to find time for the Board and Senior managers to refresh their knowledge in an ever changing regulatory environment. Our training modules cover:

- AML / CFT / CPF Board and Senior management training in line with regulatory requirements – including Business Risk Assessment, Risk Appetite and establishing effective policies, procedures and controls

- Risk management – how to identify and manage relevant business risks to the business across business strategy / model, governance, operations, conduct and financial crime

- Corporate governance and Commission expectations – refresh yourselves with an overview of director and Board responsibilities in line with the Minimum Criteria for licensing, Finance Sector Code of Corporate Governance, and other rules and principles relevant to the business

- Compliance Monitoring Programme, effectively assessing the systems and controls – what falls within the CMP scope, how to ensure effective testing, how to identify and remediate breaches, what to report to the Board and/or Commission

Everything Financial Crime

Catering for all employees, the training is tailored to the regulatory requirements with practical examples relevant to your business. The topics covered are:

- AML / CFT / CPF – covering the training requirements outlined in the Rules of the Handbook

- Understanding Guernsey’s financial crime framework, how it is relevant to your business, how to identify relevant high-risk factors and how to effectively mitigate, manage and review those clients – covering the NRA, BRA, customer risk assessments, high-risk factors, examples of effective mitigation management, and undertaking effective scrutiny and monitoring of transactions and activities

- Suspicious Activity Reports, training for all staff – legal requirements, effective internal reporting, offence of tipping off, the role of the MLRO and externalising suspicion to the Financial Intelligence Unit

- Knowing your client and the importance of onboarding – identifying all relevant risks, understanding the control, nature and purpose of your customer, identifying Key Principals and CDD, ECDD and Enhanced Measures requirements, understanding the underlying activities and effective mitigation and management of overall high-risk rated clients

- Sanctions, understand sanctions, effective monitoring and reporting, what to do and not to do if you get a sanctions hit

- Proliferation Financing, understand PF, dealing with dual use goods, risks and red flags and effective mitigation through a practical risk based approach

Supervised Roles

For staff new to the position, or requiring refresher training, we can assist with:

- Money Laundering Reporting Officer / Nominated Officer – Role and responsibilities, disclosure and sanctions requirements, ensuring an effective internal reporting policy and procedure, investigating suspicions, avoiding tipping off, externalising to the Financial Intelligence Unit and regulatory reporting to the Board

- Money Laundering Compliance Officer – role and responsibilities, identifying the financial crime framework, implementing effective controls, testing , Board reporting, remediation and assurance

- Compliance Officer – understanding the role, identifying your business compliance framework, implementing effective controls, testing, Board reporting, remediation and assurance

Contact us

Please contact us for any further information about the services that we offer.