Training

Case Study Led Training

ThreeSixty’s training is underpinned by case studies based on real world experiences. Not only do you learn the legal and regulatory requirements, but you will also understand the practical application.

Comments from attendees:

“I enjoyed the case studies because it is nice to be able to transfer knowledge”

“Found the training useful & very interesting. Good to include discussion within the group”

“The actual case studies – helps to put it in context”

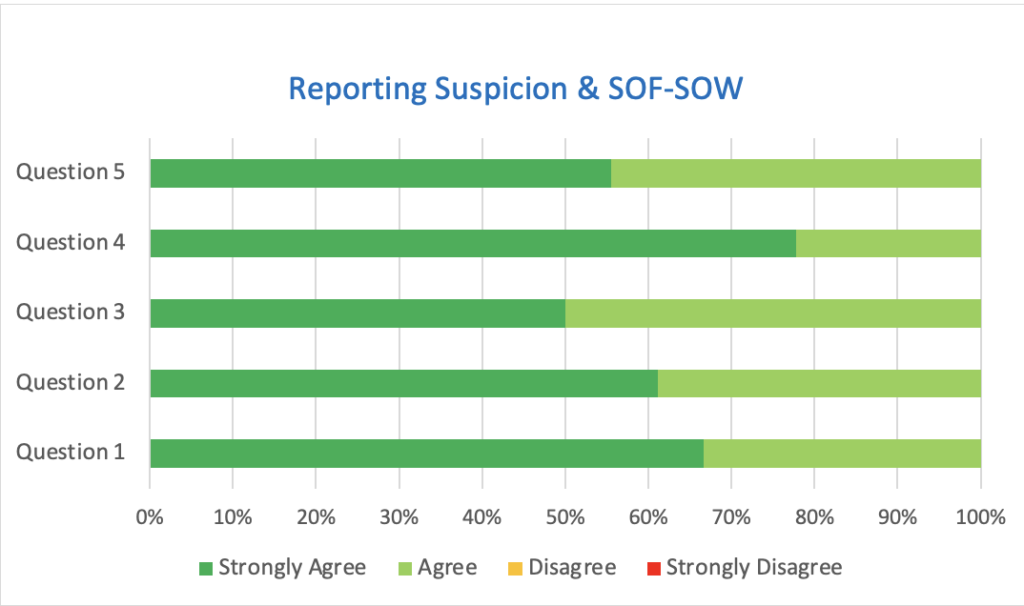

- The objectives of the training were met.

- The training material was relevant and easy to follow.

- The training was not too long.

- The trainer(s) were engaged and able to answer any questions.

- I would attend future ThreeSixty training sessions.

We offer a range of training packages which draw upon our regulatory and Industry knowledge and practical experience to ensure businesses and their staff meet regulatory standards. Suited for both regulated and unregulated businesses, we have a friendly approachable training style to encourage learning in a relaxed environment. We can deliver in person, virtually, or on a one to one basis.

We tailor our courses to your business needs to ensure it is relevant to the activities undertaken and the risks faced.

Our list below is not exhaustive and we can design and tailor training packages to meet your needs, please contact us to find out more.

For the Board

- Risk management, how to identify and manage relevant business risks.

- Corporate governance and Commission expectations. (For both executive and non-executive directors).

- AML/CFT offences penalties and liabilities

- Business Risk Assessment, Risk Appetite and establishing policies, procedures and controls.

- Assessing the effectiveness of systems and controls.

Financial crime

Catering for all staff and directors, the training is tailored to the regulatory requirements with practical examples relevant to your business. The topics covered are:

- Countering money laundering and financing terrorism (Introductory to advanced).

- Proliferation and proliferation financing.

- Suspicious Activity Reports – All about Disclosure.

- Enhanced Measures.

- Knowing you client and the importance of on boarding (Due diligence / Enhanced Due Diligence and KYC).

Supervised positions

For staff new to the position, or requiring refresher training, we can assist with:

- Money Laundering Reporting Officer / Nominated Officer.

- Money Laundering Compliance Officer.

- Compliance Officer.

Contact us

Please contact us for any further information about the services that we offer.

- Stephen Cummins 07911 752478

- Mark Domaille 07781 163727

- enquiries@threesixty.gg

- visit us on LinkedIn

- follow us on facebook